|

Although many people equate “estate planning” with having a will, there are many advantages to having a trust rather than a will as the centerpiece of your estate plan. While there are other estate planning tools (such as joint tenancy, transfer on death, beneficiary designations, to name a few), only a trust provides comprehensive management of your property in the event you can’t make financial decisions for yourself (commonly called legal incapacity) or after your death. One of the primary advantages of having a trust is that it provides the ability to bypass the publicity, time, and expense of probate. Probate is the legal process by which a court decides the rightful heirs and distribution of assets of a deceased through the administration of the estate. This process can easily cost thousands of dollars and take several months to more than a year to resolve. Of course, not all assets are subject to probate. Some exemptions include jointly owned assets with rights of survivorship as well as assets with designated beneficiaries (such as life insurance, annuities, and retirement accounts) and payable upon death or transfer on death accounts. But joint tenancy and designating beneficiaries don’t provide the ability for someone you trust to manage your property if you’re unable to do so, so they are an incomplete solution. And having a will does not avoid probate. Of note, if your probate estate is small enough - or it is going to a surviving spouse or domestic partner - you may qualify for a small estate proceeding. For example in the District of Columbia a small estate proceeding can be opened for an estate less than $40,000. If you own property in another state or country, the probate process will be even more complicated because your family may face multiple probate cases after your death, one in each state where you owned property - even if you have a will. In general, if your assets are more than that amount, you will not qualify for a small estate probate proceeding, and should strongly consider creating a trust. Considering the cost of probate should also be a factor in your estate planning as creating a trust can save you both time and money in the long run. Moreover, if you own property in another state or country, the probate process will be even more complicated because your family may face multiple probate cases after your death, one in each state where you owned property - even if you have a will. Beyond the cost and time of probate, this court proceeding that includes your financial life and last wishes is public record. Trust Provides PrivacyA trust, on the other hand, creates privacy for your personal matters as your heirs would not be made aware of the distribution of your assets knowledge of which may cause conflicts or even legal challenges. Trust Provides for Loved OnesA common reason to create a trust is to provide ongoing financial support for a child or another loved one who may not ever be able to manage these assets on their own. Through a trust, you can designate someone to manage the assets and distribute them to your heirs under the terms you provide. Giving an inheritance to an heir directly and all at once may have unanticipated ancillary effects, such as disqualifying them from receiving some form of government benefits, enabling and funding an addiction, or encouraging irresponsible behavior that you don’t find desirable. A trust can also come with conditions that must be met for the person to receive the benefit of the gift. Trust Protects During IncapacityIf you ever become incapacitated your successor trustee - the person you name in the document to take over after you pass away - can step in and manage the trust’s assets, helping you avoid a guardianship or conservatorship (sometimes called “living” probate). This protection can be essential in an emergency or in the event you succumb to a serious, chronic illness. Unlike a will, a trust can protect against court interference or control while you are alive and after your death. Trusts are not simply just about avoiding probate. Creating a trust can give you privacy, provide ongoing financial support for loved ones, and protect you and your property if you are unable to manage your own assets. Simply put, the creation of a trust puts you in the driver’s seat when it comes to your assets and your wishes as opposed to leaving this critical life decision to others, like a judge. To learn more about trusts - and estate planning in general, including which type of plan best fits your needs - contact us today.

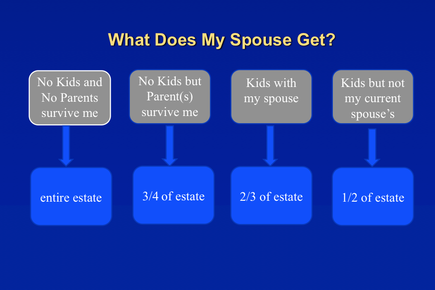

Many people think that if they die while they are married, everything they own automatically goes to their spouse or children. They’re actually thinking of state rules that apply if someone dies without leaving a will. In legal jargon, this is referred to as “intestate.” In that case, the specifics will vary depending on each state's law, so where you live when you die can significantly change the outcome for your family.

However, the general rule is that your spouse will receive a share, and the rest will be divided among your children. Exactly how much a spouse will inherit depends on the state, though.

Now, it may seem like, "So far, so good." Your spouse is getting an inheritance, so are the kids. But here are some examples of how the laws can fail many common family situations.

First off, if both parents of minor-aged children die intestate, then the children are left without a legal guardian. Kids don't automatically go to a godparent, even if that's what everyone knew the parents had intended. Instead, a court will appoint someone to be the children's guardian. In such situations, the judge seeks to act in the children’s best interests and gathers information on the parents, the children, and the family circumstances. But the decision is up to the court, and the judge may not make the decision that you, as a parent, would have made. When it comes to asset division, in most cases, state intestacy law presumes that a family consists of a husband, wife, and their natural-born children. But, that’s not necessarily the way many families are structured, and things can become legally complicated quickly. According to Wealth Management, one analysis has 50 different types of family structures in American households. Almost 18% of Americans have been remarried, and–through adoption and stepfamilies–millions of children are living in blended families. The laws just haven't kept up, and absurd results can occur if you rely on intestacy as your estate plan. Stepchildren that you helped raise (but didn’t legally adopt) may end up with no inheritance, while a soon-to-be-ex-spouse may inherit from you. What if You and Your Spouse Are Separated?

State law decides what happens to your estate if you are separated from your spouse when you die. Much of the time, the court ignores your separation and just considers you still legally married.

Unless you have a prenuptial or postnuptial agreement, it is extremely difficult to disinherit your spouse. Again, even if a spouse is omitted from a will, state laws might choose to give a surviving husband or wife a share of the assets. If you are separated from your spouse, and your divorce is pending, you should definitely talk with your divorce lawyer and an estate planning attorney about your options. Creditors Win

Intestacy provides no asset protection or preservation benefits. Without any protections in place, an estate's assets are still vulnerable to creditors, lawsuits, and others who may claim entitlement to the property. These claims would take precedence over the statutory requirements for inheritance. In other words, the family may not receive the lion's share of the estate. They'd get the leftovers.

The best way to safeguard and pass along what you’ve worked so hard to build is to talk to a qualified estate planning attorney. Protect yourself, your family and your assets by contacting us today.

When most people hear the term “dynasty trust,” they assume it’s something for only the wealthiest of families. However, dynasty trusts are not as out of reach as you might think, and can be used by many more families of a greater wealth spectrum than currently use them.

Demystifying dynasty trusts

Dynasty trusts keep your wealth within your family for a long time. When properly designed, they can last forever. Dynasty trusts are, however, irrevocable and are therefore perceived by some as inflexible. Since adjustments to this type of trust require a great deal more work than they do for a garden-variety revocable living trust you are probably more familiar with, we need to have an in-depth understanding of your needs and goals to create your family’s dynasty trust.

But for many families, the benefits far outweigh the drawbacks of irrevocability and perceived lack of flexibility. While there are several types of laws affecting these trusts that vary state-to-state, dynasty trusts offer several benefits:

How is a dynasty trust different than other types of irrevocable trusts?

Simply put, a dynasty trust is one that is designed to consolidate and build intergenerational wealth over a very long time. Other common types of irrevocable trusts you’ve heard about (like GRATs, ILITs, QPRTs, CRTs, etc.) are created to achieve a particular tax result. Dynasty trusts build on these planning strategies and are appealing because they allow you to take a long view of estate planning for your family.

Why is now the time to explore this option?

In today’s favorable tax and legal environment, dynasty trusts can make more sense than ever - especially if your family has significant life insurance policies, a small business, or other assets that might increase in value significantly (like founder’s stock or vacant land in a fast growing area).

Families haven’t always had such wide opportunities to explore dynasty trusts. Many states have laws against perpetuity designed to prevent trusts from lasting many generations. While these laws still exist in some states, there is a trend toward less rigid application or even outright removal of these rules. Admittedly, one reason for the growth in popularity of these trusts is that financial institutions stand to benefit from management fees associated with them. But your family benefits as well because wealth that’s consolidated and managed (as in the case of a dynasty trust) tends to be more likely to be preserved and successfully pass from one generation to the next versus wealth that’s divided and distributed (as in the case of many garden-variety estate plans). Is a dynasty trust right for you and your family?

Most people think of dynasty trusts as something only the highest net worth families would even consider. And while they do require the help of a skilled estate planning attorney who can navigate the complex interplay between state and federal laws, they can be an attractive option for your family. Dynasty trusts offer an excellent method to pass along lifelong financial security to your loved ones for generations to come.

Give us a call today to talk about how we might build a dynasty trust that stays with your family through whatever the future may bring. We will make sure it complies with all applicable laws, provides maximum protection for your legacy and furthers your goals. |

Archives

December 2023

|

Services |

Company |

|

RSS Feed

RSS Feed